schedule c tax form meaning

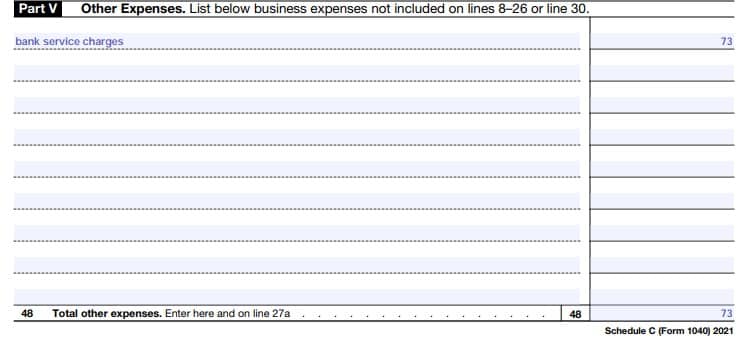

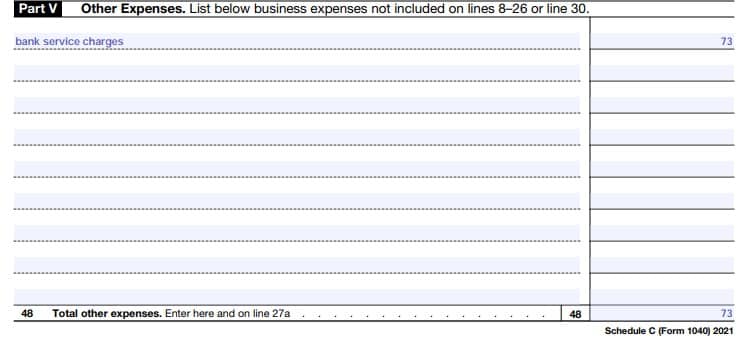

Records for any of your inventory. Click Review next to Other miscellaneous expenses.

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Schedule C details all of the income and expenses incurred by your business and the resulting profit or loss is included on Schedule 1 of Form 1040.

. But what if your self-employment income comes from your side gig and youre employed in a day job. Any receipts you have from business expenses. Schedule C is a place to record the revenue from your business and all the costs associated with running your business.

You may not have created a business but if you are working as a contract employee a consultant a self-employed individual etc Schedule C is used to report the income and loss and calculate your Self-Employment tax. Youll receive a W-2 from your employer but youll still need to file a Schedule C to report your side gig income. Schedule C is a tax form used by most unincorporated sole proprietors to report their business income and expenses.

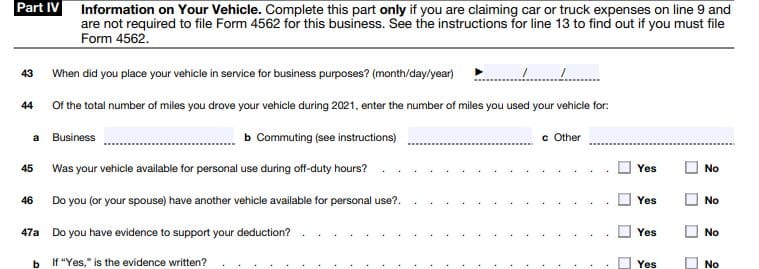

An accounting method is chosen when you file your first tax return. If you use the same accounting categories as the IRS you can. An accounting method is the method used to determine when you report income and expenses on your return.

What Should Be Reported. The net profit or loss from this schedule is reported on Form 1040. Who Files a Schedule C Tax Form.

Typically a sole proprietor files their personal and business income taxes together on one return. View solution in original post. A Schedule C form is a tax document filed by independent workers in order to report their business earnings.

On the other hand the accrual method accounts for revenue when it is earned and expenses goods and services when they are incurred. The revenue is recorded even if cash has not been received or if expenses have been incurred but no cash has been paid. The IRS disregards an LLC with only one membercalled an.

Profit or Loss From Business Sole Proprietorship is used to report how much money you made or lost in a business you operated by yourself. Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year. The form reports how much of the income from your business is subject to tax or whether you have a loss for tax purposes.

Schedule C is the form used to report income and expenses from self-employment. In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C. To fill out this form youll need to gather some important information.

Individuals who do have taxes deducted from their income in one workplace may still need to file a Schedule C if they have a side gig or work as an independent contractor elsewhere. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

Accrual accounting is the most common method used by businesses. Besides sole proprietorships three other types of business may use Schedule C. Its used to report profit or loss and to include this information in the owners personal tax returns for the year.

You fill out Schedule C at tax time and attach it to or file it electronically with. The Schedule C tax form is used to report profit or loss from a business. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Taxpayers who earn income from a business from freelancing or from working as independent contractors are considered by the IRS to be self-employed. What is a Schedule C. This can encompass owning a digital or brick-and-mortar small business freelancing contracting and gig work such as ride-share driving.

The Schedule C tax form combines a sole proprietors business income and expenses to determine the net profit reported on Form 1040. Schedule C is used to report income or loss from a business you operated as a sole proprietor. Its part of the individual tax return IRS form 1040.

The Schedule C form is designed to let sole proprietors write off as much of their expenses as possible from their tax bill in hopes. If you use accounting software Schedule C should closely match your profit and loss statement. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded.

A net profit or loss figure will then be calculated and then used on the proprietors personal income tax return on form 1040. Filling out the Schedule C form involves listing information about your business and business income as well as any expenses. Click Edit next to your business.

You will want to have. Schedule C is an important tax form for sole proprietors and other self-employed business owners. Its important to note that this form is only necessary for people who have had income reported on 1099 forms meaning they are considered contract employees rather than full employees of the company or organization contracting them.

Usually if you fill out Schedule C youll also have to fill out Schedule SE Self-Employment Tax. Schedule C is an IRS form that self-employed people use to report profit or loss from their business. They must fill out Schedule C of Form 1040.

If you dont need the description you can delete that miscellaneous expense. Click EditAdd next to your business. IRS Schedule C is a tax form for reporting profit or loss from a business.

Schedule C is the form that must be filed by sole proprietors and single-member LLCs. That profit or loss is then entered on the owners Form 1040 individual tax return and on Schedule SE which is used to calculate the amount of tax owed on earnings from self-employment. If you wish to change your accounting method you need permission from the IRS.

It is a form that sole proprietors single owners of businesses must fill out in the United States when filing their annual tax returns. How to File a Schedule C. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The resulting profit or loss is typically considered self-employment income. Otherwise enter an amount. Schedule C focuses on quantifying the profits and expenses you incurred through your business activity.

Schedule C - Accounting Method. Find the miscellaneous expense that doesnt have an amount next to a description. You must use the same accounting method from year to year.

The 1040 Schedule C is a method of reporting income made outside of a work arrangement that automatically deducts taxes from income.

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How To Fill Out Your 2021 Schedule C With Example

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Form 11 Schedule C Seven Outrageous Ideas For Your Form 11 Schedule C Tax Forms Federal Income Tax Schedule

How To Fill Out Your 2021 Schedule C With Example

What Is A Schedule C Irs Form Turbotax Tax Tips Videos

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Form 1040 Sr U S Tax Return For Seniors Definition Tax Forms Irs Tax Forms Ways To Get Money

/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)

Form 2441 Child And Dependent Care Expenses Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)